- Cannabis

-

by @admin

The cannabis/hemp industry is growing in the US, with many states legalizing the use & growing of medical and recreational marijuana. As per New Frontier Data, the cannabis market in the U.S. is expected to reach $72 billion annually by 2030, up from $32 billion in 2023. Yet, the industry remains one of the most under-served by the banking industry. 420 friendly banking that holds the promise of financial inclusion for cannabis-related enterprises can help them to grow.

As the cannabis industry gains legality and legitimacy in various regions, so does the need for tailored financial services. Are you also looking for a 420 friendly bank and want to know how they help your cannabis business, or what cannabis friendly banks are there to help you. We’ll delve into all the details regarding these questions. So keep on reading…

What Are 420 Friendly Banks or Cannabis Banks?

420 friendly banking refers to financial institutions open to providing services to marijuana businesses, including medical and recreational marijuana. As of early 2021, the Financial Crimes Enforcement Network (FinCEN) reported that 515 banks and 169 credit unions provided cannabis banking services to marijuana-related businesses (MRBs).

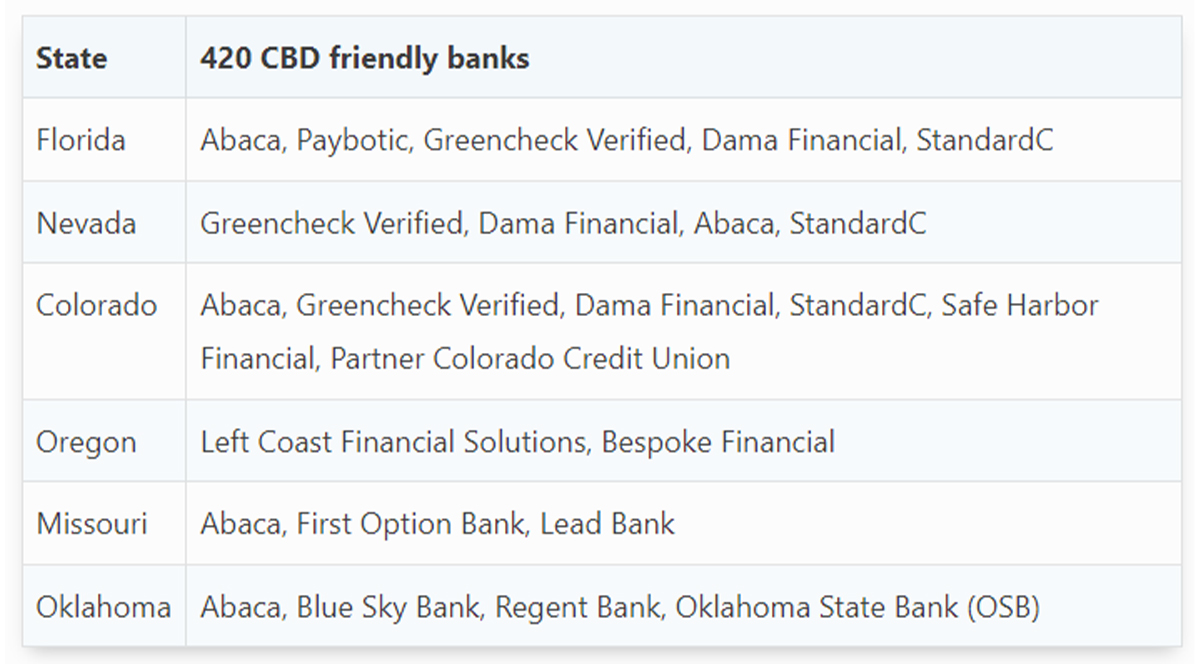

Image Source: FiFi Finance Team, US

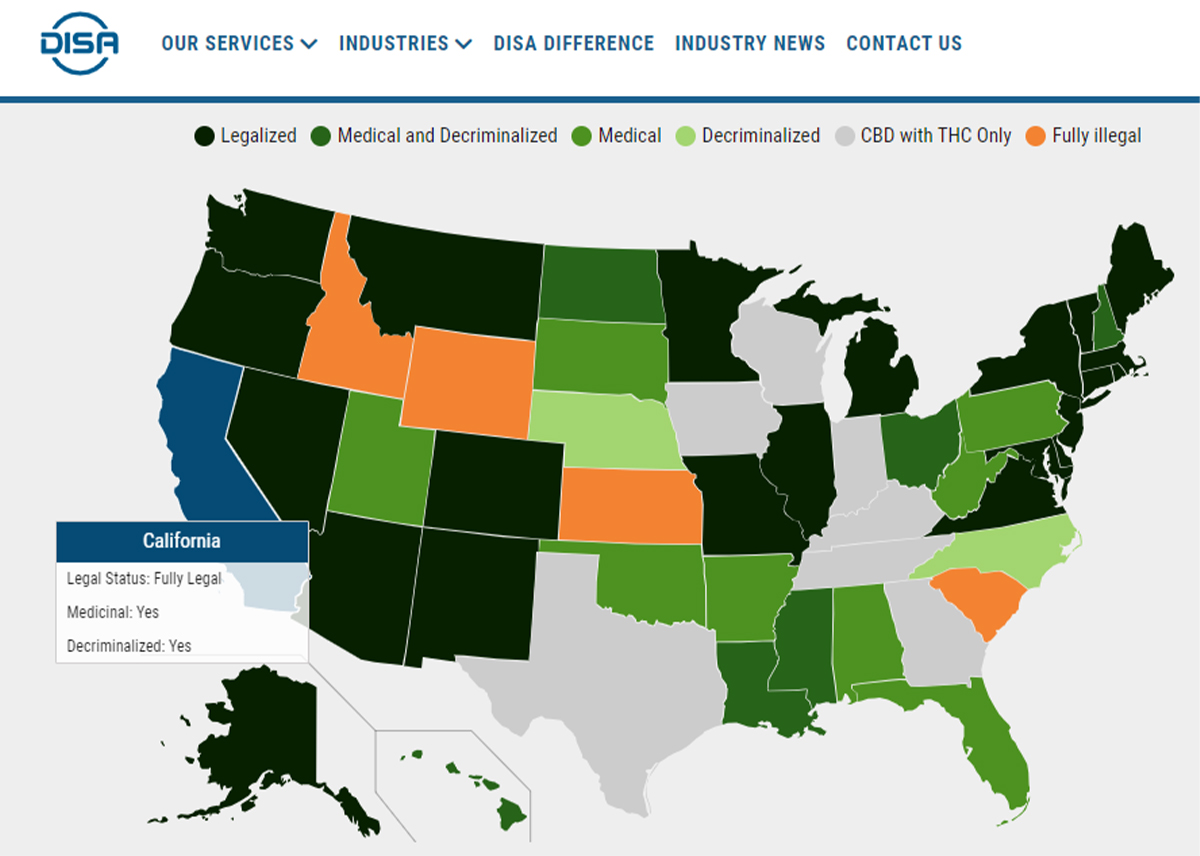

Operating cannabis companies is legal in some US states. Therefore, some financial institutions allow transactions for cannabis businesses. Unfortunately, not many CBD banks openly advertise themselves as cannabis friendly or willing to work with marijuana businesses. They won’t take the risk of being penalized by the federal government. See the data of Marijuana Legality By Us State – Updated Aug 1, 2023, by DISA, where you can see which states have fully legalized marijuana use.

Marijuana financial institutions are legally allowed to do business with the cannabis industry. However, they must deal with a dizzying array of federal regulatory requirements that often deter them from working with cannabis businesses.

Growth Of Hemp-derived CBD products

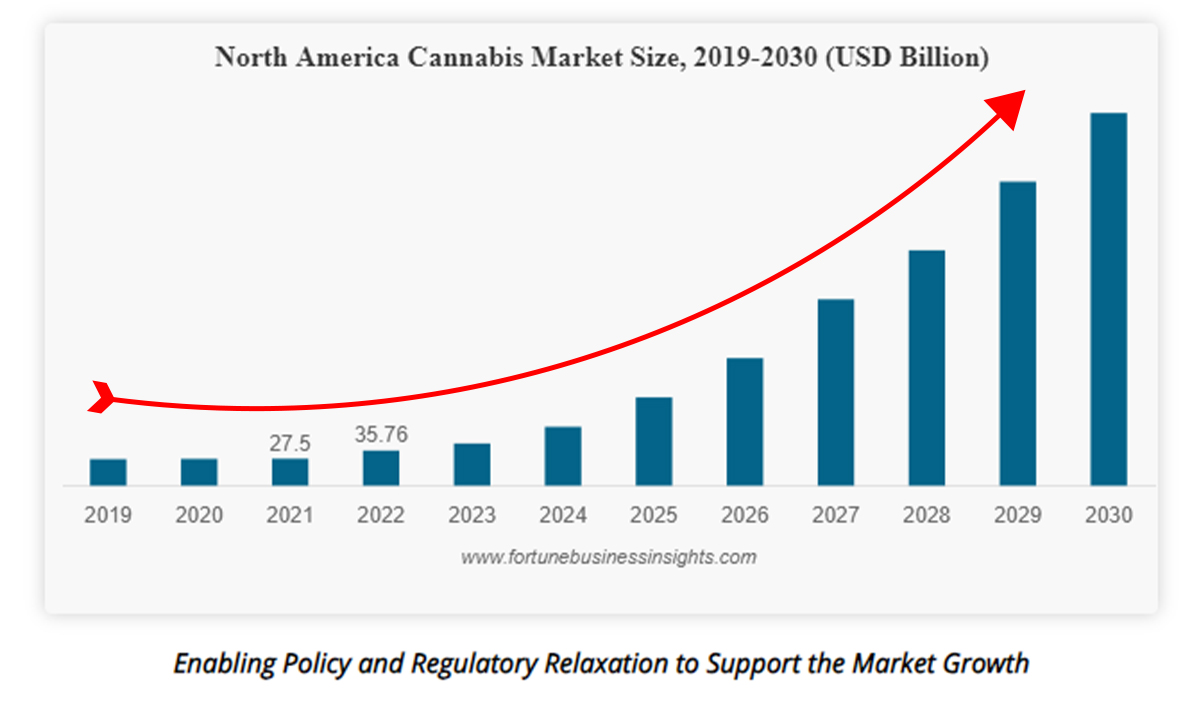

You can’t avoid hemp-derived CBD products anymore. CBD products are everywhere these days, from the edibles you can get at the pharmacy to the hemp-based skin cream your mom uses in the shower. Thanks to the Farm Bill, which made it legal to extract CBD from industrial hemp plants, the cannabinoids and hemp industry is booming. See the data by Fortune Business Insights showing the future growth of the cannabis industry.

Data Source: Fortune Business Insights

Consumer demand for CBD products in the United States is expected to grow from $2.2 billion in 2018 to an estimated $2.7 billion in 2023. And with this tremendous growth, there is a surge in financial institution needs as well.

Benefit Of Taking Help From Top 420 Friendly Banks

Cannabis businesses seeking to leverage the services of “cannabis banks” or “420 friendly banks” face unique challenges and opportunities. These financial institutions specialize in providing marijuana banking solutions tailored to the needs of the cannabis industry, which often struggles to access traditional banking services due to legal and regulatory complexities. Here’s how cannabis businesses can benefit from such banks:

— Legitimacy and Compliance

Cannabis friendly banks understand the legal intricacies of this CBD industry. They help your business navigate complex regulatory FDA frameworks, ensuring compliance with local, state, and federal laws. This expertise is vital for your CBD businesses to operate legitimately and avoid legal pitfalls.

— Tailored Financial Solutions

Cannabis banks offer core dispensary banking services such as opening business accounts, payment processing, cash handling, and electronic fund transfers. Banks allow your hemp business to move away from operating solely in cash, enhancing security and transparency. They often provide tailored financial solutions, including lines of credit, merchant services, and business loans.

— Cash & Risk Management

Dealing primarily in cash is a challenge for many cannabis businesses due to limited marijuana banking options; we’re sure you also might face these issues due to laws. Cannabis banks offer cash management solutions that allow dispensary businesses to streamline their operations and reduce the risks associated with cash transactions. They also assess and manage the risks, providing businesses a safe and compliant environment for their financial transactions.

— Have Specialized Expertise

Cannabis banks have CBD professionals who understand the intricacies of this industry. Their expertise ensures businesses like yours receive advice and services tailored to their needs. Moreover, they often share a mission to support and normalize the industry.

— Staying Updated

The legal & regulatory landscape for cannabis is dynamic and can change rapidly. Cannabis banks stay updated on these changes and help CBD businesses adjust their strategies accordingly. Some cannabis banks also advocate promoting a better understanding of the industry’s potential benefits.

How To Play Safe & Find the Right Cannabis Friendly Bank

With federal and state red tape, your best bet for cannabis banking is to start with local community banks and credit unions with fewer federal regulations. Then, you can narrow your list to financial institutions or 420 friendly banks that take on high-risk customers and shoulder the responsibility to ensure they comply with US state regulations.

Since many CBD banks don’t advertise that they have cannabis businesses as their clients, it never hurts to ask. Inquire about selected banks’ compliance standards, requirements, and reporting procedures. It is often hard to tell which banks do and do not offer such services – as it isn’t commonly advertised.

Here are a few practical tips to help legitimize your business in the eyes of the weed banking industry:

1. Transparent communication:Maintain an honest relationship with your bank, especially if your CBD business experiences any changes after becoming a customer. Your bank will not identify these modifications as suspicious transactions that may pose a risk to your account.

2. Detailed documentation:Be prepared to receive follow-up questions from weed banks. You may need to produce detailed copies of your sales records, marijuana license, product information, tax identification numbers, and compliance documentation and inventory logs to comply with marijuana banking regulations.

3. Avoid illegal workarounds:Weed banks must comply with the (FinCEN) Financial Crimes Enforcement Network’s guidelines, which include attempting to conceal or disguise marijuana-related business activities by using an intermediary to deposit cash.

Each financial institution generally has internal policies limiting the number of high-risk customers they can take on. Even 420 friendly banks may only accept a potential client if the risk level is reasonable. Indeed, significant banks seldom take on cannabis-related businesses for this exact reason. Be ready to do your due diligence by producing all the necessary documents. Moreover, you must also focus on online brand presence to help you establish yourself as an authority in the industry.

Want to grow your CBD brand online? Here’s a recommended guide for you: Weedmaps vs Leafly: Which One Is Better For Cannabis Business?

4 Cannabis Friendly Banks & Credit Unions That Assist CBD Businesses

— The Numerica Credit Union:

The first credit union in Washington to provide cannabis banking services. They only work with licensed CBD producers, processors, and retailers in Washington.

— The Salal Credit Union:

It offers many cannabis banking services for cannabis businesses in its community. Membership eligibility extends to licensed companies operating in Washington and Oregon.

— Timberland Bank:

They offer services to the cannabis industry. They don’t advertise their cannabis accounts on their website; they only have branches and ATMs in Washington state.

— Partner Colorado CU:

They offer cannabis banking services through Safe Harbor Financial, a Partner Colorado CU division. After banking with Safe Harbor for 1 year, you’ll be eligible to apply for commercial real estate loans & home mortgages for cannabis business owners.

To Summarize:

The cannabis banking landscape has become increasingly complex due to the introduction of 420 friendly banks, which provide legal and compliant financial support for cannabis/hemp-related businesses. These banks offer tailored solutions to address legal issues and essential services such as banking, loans, and risk management. Partnering with these banks is critical to the cannabis industry’s growth and sustainability.

A cannabis SEO company like CBDHempLive can help complement this growth by improving online brand visibility, search engine ranking, high-quality link-building & GMB ranking, and brand traffic. Through optimizing digital strategies, we can effectively link your cannabis businesses to your target CBD audiences, thus promoting brand growth, followers, ratings, and recognition.

Answers To Common Questions: Quick Overview

Can CBD businesses open bank accounts with traditional banks?

Due to FDA regulatory uncertainty, most traditional banks are hesitant to provide services to cannabis businesses such as yours. Banks or credit unions focusing on 420 friendly banks or CBD-specific services are more likely to offer services to cannabis businesses.

What documents are needed to open a CBD business bank account?

You must provide business licenses, product information, tax identification numbers, and compliance documentation showing THC content below legal limits. Be prepared to receive follow-up questions from weed banks. You may need to produce detailed copies of your sales records, and inventory logs to comply with marijuana banking regulations.

Do CBD banks provide credit card payments, loans, or lines of credit facilities?

Many CBD banks offer merchant services that enable cannabis businesses to process credit card payments online and in-store. Some also offer financing options like business loans or lines of credit, but T&C may vary from bank to bank.

What are the challenges of handling cash for CBD businesses?

Cash transactions pose security risks, and that’s where CBD banks offer cash management solutions to address these challenges. They also guide your business through compliant international transactions.

Can CBD businesses access online cannabis banking services?

Many CBD banks provide online banking platforms, allowing businesses to manage transactions, view balances, and pay bills digitally. Moreover, some also offer investment or financial advisory services. You can consult with the bank to explore available options & get more details.

How can CBD banks help with compliance?

CBD banks specialize in the industry’s legal federal requirements. They help businesses navigate required regulations to ensure operations are compliant.

Can CBD businesses benefit from SEO services?

Absolutely yes! SEO services can enhance online visibility, driving organic traffic to your website and boosting brand recognition among potential customers. This authority & recognition can also help banks to look at your brand as trustworthy. Need help with SEO & brand recognition services? Contact our expert team now @+1 650 262 7333